The Real Estate Market Already Crashed

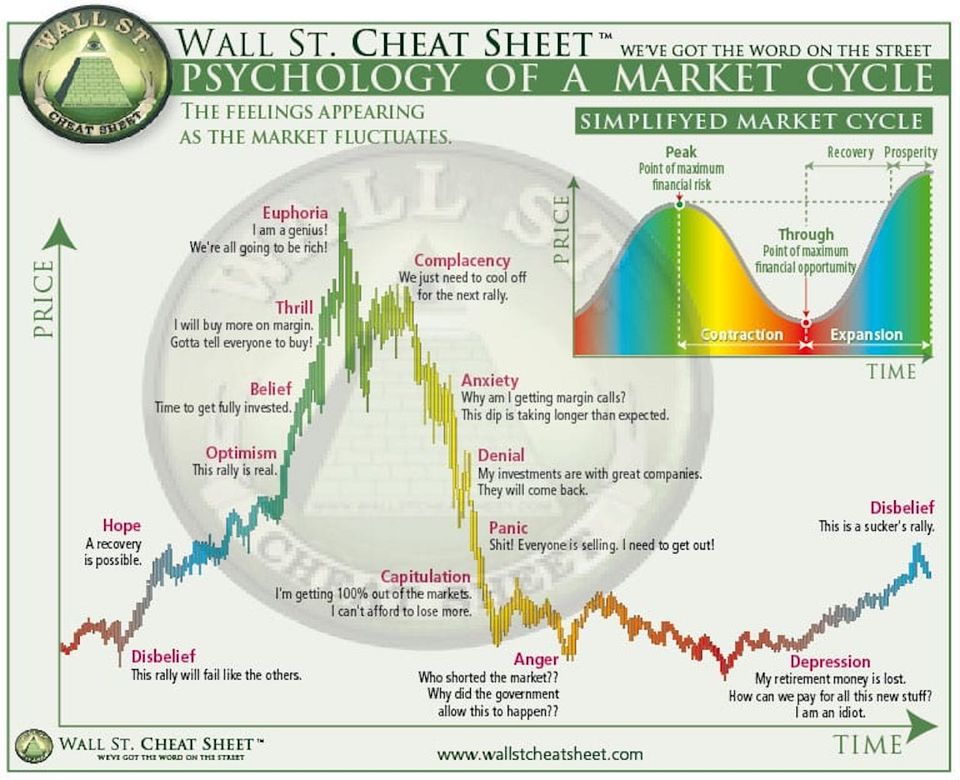

Did you miss it? If so, you probably still believe in fairy tales like unicorns and democracy and the dollar. You believe that a price indicates value. That seeing a number go up on a screen represents reality. I'm here to try to disabuse you of these notions before reality does it for you. But it's tough. I've tried with many people and most don't get it. This stuff is very simple so you can't just say people are stupid. I have better success with kids than adults, so I blame a lifetime of "dollar indoctrination" instead. Adults believe so completely in the magic screen numbers that the simplest concepts of value are firewalled from comprehension. I've been there. I'm still blasting through firewalls on the daily myself, but the ones I've gotten through I can turn back and explain to others. I only try to explain when people ask, mind you. If you want to stay firewalled I wish you well.

For those remaining brave souls, first let me say that I'm only talking about real estate in terms of prices in this article. The most important thing to understand from this article is that a market price can keep going up yet the market can still crash. And I'm only using real estate in this article because from a mainstream perspective it's the strongest market recently. Using stocks or crypto or metals isn't a good way to explain this right now cause "everyone knows" those markets already crashed. But yes the real estate crash already happened as well, despite what the screens tell you. Obviously there is supply and demand and lending qualifications and interest rates and specific geographic areas stronger than others, but I don't want to muddy the waters, mainly because these are functions of people believing the magic numbers on the screen, which are fake, which you will soon understand.

With all that in mind, I present a thought experiment. The average price of a home in dollars in America has gone from $375,000 to $525,000 over the course of about 2 years, from 2020 to present day. That's a 60% increase. Not too shabby! Now imagine if the average cost of living quadrupled (which means a 300% increase) during the same period. So if your grocery bill was $200 a week in 2020, imagine it's $800 a week right now. Your electricity bill went from $100 to $400. Gas from $2 to $8. Let's say the stock market and crypto and precious metals went way up as well (and stayed there), to really drive the following point home: Would anyone be talking about the cost of real estate???

Of course not. It's the last thing people would be talking about. Effectively, the real estate market would have utterly crashed like no time in history, despite the dollar price of homes increasing like no time in history. Thankfully the cost of living hasn't quadrupled, but it has actually as much as doubled (100% increase) for many people, depending on your circumstances. Personally speaking, money is flying out of my wallet like never before. All this is easy to feel but hard to quantify. Let's try anyway...

Quantification Manipulation

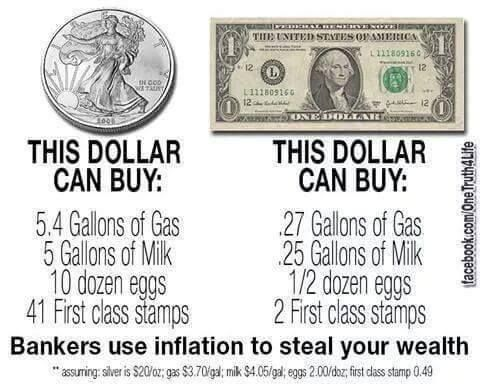

Obviously the above thought experiment is an exaggeration (which could never happen, right?). But it serves to drive home the point: value is always relative. A price in dollars is just a quick mental model at best. If you don't understand how actual value works, you will have your wealth silently stolen by people who do. But let's try to (a) bring this thought experiment closer to the reality of the last 2 years, and (b) quantify things a little better.

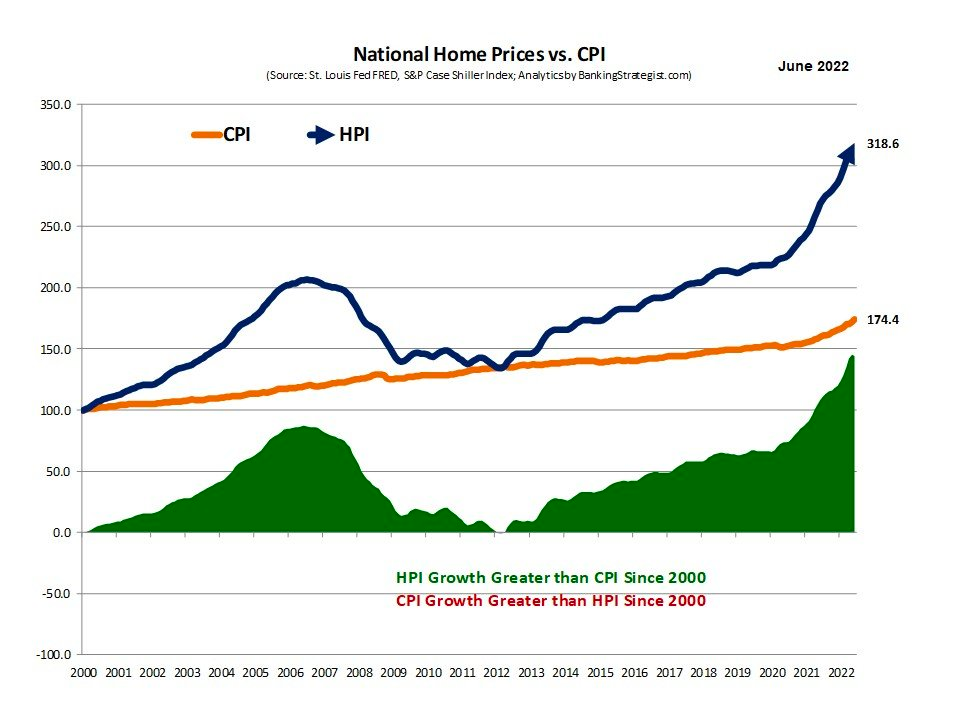

The banksters quantify the cost of things using price indices. A price index is a number that tries to represent the consumer cost of a particular sector or commodity over time. The two indices we will look at here are the Consumer Price Index (CPI) and the House/Home Price Index (HPI). CPI is the official measure of what most people call inflation[1]. And there are several HPIs out there, but they all show the same general trend:

If you believe in the above chart you would think real estate investment has been a good bet (aka inflation hedge) relative to the cost of everyday expenses like food, gas, electricity, entertainment, etc. But is this true?

Can We Trust the HPI and CPI Numbers?

Well obviously not. We live in such a low trust society that every single financial action you make you simply assume you're getting screwed somehow. You just don't know how. But don't settle for that shit! Find out how you're being screwed! This is scary because ultimately the answer involves personal responsibility. It involves acknowledging that yes there are bad actors out there, but it is what it is. What are you gonna do about it? Arm yourself! Defend yourself! Ignorance is bliss for a short time, but not forever.

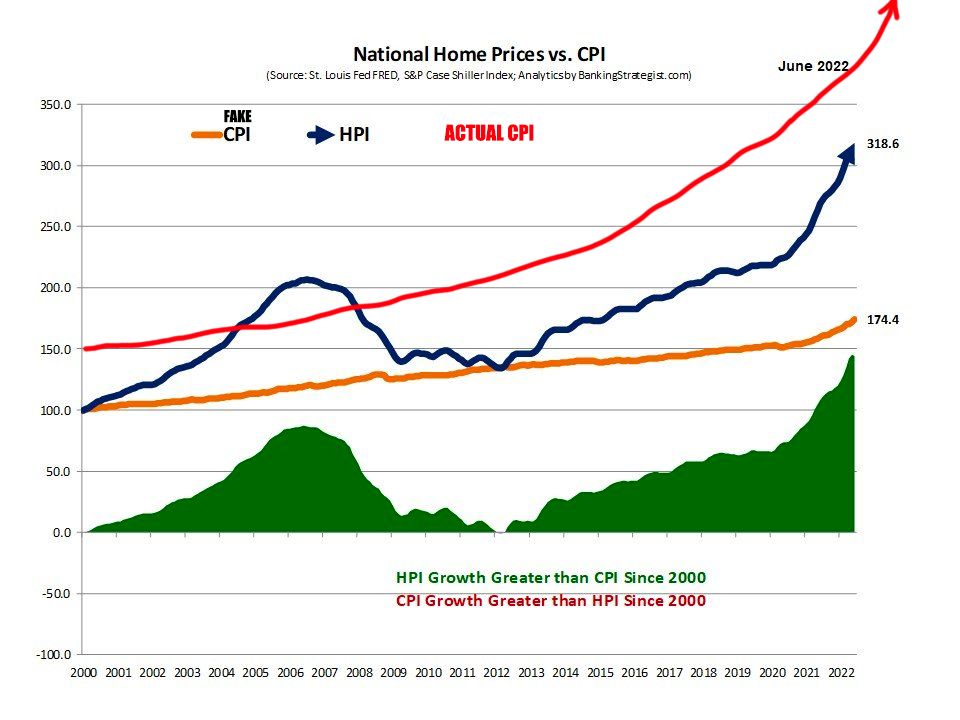

So let me provide some knowledge weapons for your defense. First off, HPI is actually a pretty solid indicator. It's hard to fudge these numbers because real estate prices are such an unambiguous public datapoint. Of course the number is manipulated, but it can only be done very indirectly. Compare that to CPI which is a bankster's wet dream as far as economic indicators go. This number is manipulated in so many ways it would have to be a separate blog post. But as a gut check, since 2020, your general expenses have supposedly increased by 6-9% per year. In other words, by official numbers, if something cost $10 at the beginning of 2020, it costs you between $11-$12 now. That actually sounds bad enough now that I've written it out, but at the same time countless major costs in my life have gone up by at least 20%. Gas alone doubled at one point and is now 50% higher than 2 years ago. Go through your own finances and then you can adjust the above chart to something more accurate:

Now you might think that red line is an exaggeration. And in terms of pure dollar price for a given product or service, sure, maybe it is (maybe). But remember in the intro where I mentioned that the concept of price itself is bullshit? How you can only value assets relative to other assets and not an imaginary currency? This becomes especially important when you start considering the concept of hidden inflation.

It Lurks In The Shadows...

And it doesn't wait to strike. It's striking you constantly. If we're talking about food for example, hidden inflation means that the price might stay the same, but the quality and/or quantity and/or size goes down. For example food is being produced more and more by centralized factories and farms where GMO is the way to go, and "organic" is a label they slap on the box for a buck extra. The contents might weigh the same as 10 years ago but half the weight is now corn syrup and soybean oil. Most store-bought food is essentially low-grade poison these days, even the so-called healthy stuff like fruits and veggies. And constant consumption of poison leads to health problems and lower economic output (less money being made). See my blog post on disease for more on this. You can then say that the medical treatment for a health problem is only going up by 8% per year, but what if you didn't need that treatment at all before and now you do? That's much more than an 8% increase for you personally.

You can nod your head to official HPI vs. CPI charts and think the real estate market is still doing great, but at the end of the day you're letting yourself be robbed. I'm using food as only one example of relative value but it's probably the most impactful. People collect coupons and go discount shopping and think they're saving money by buying cheaper poison. They look at bankster CPI charts and go "Yea that sounds about right!" Meanwhile they're plagued by clouds of disease that make it even harder to see how the inflation game actually works. It's quite the downward spiral, and if you don't snap out of it you'll agree with bankster numbers all the way to rock bottom.

Real Value

I mentioned gold and silver as the most "real" financial assets you can own. And yes that's the case, but it's hard to say something is real in a world of fakery. Look up paper gold if you're a goldbug and want to depress yourself. Still, in this material world gold and silver are historically amazing ways to preserve wealth. It really doesn't get better.

But who cares about the material world! You just want to be happy right? Live long and prosper? To do that you have to tap into real value: family, friends, community, skills, meaningful occupation, local production of food and goods, all that kind of stuff. As much as 2020 was designed to rob everyone of material wealth, the bigger goal was to rob everyone of non-material wealth by turning friends and families and communities against each other. Did the banksters succeed? Definitely to a large degree, but the banksters don't know how the natural world works. Sure they can hyperinflate their fake nonsense currencies into oblivion, but they can never destroy real value. Real value always bounces back.

If you enjoyed this article and want to learn more about preserving material wealth, please see https://aytwit.com/crypto_consulting.

Footnotes

- Most people think inflation means higher prices, but technically it just means an increase in the money supply. This often nudges prices higher of course, but it doesn't have to. More importantly, it's often a small factor in price increases compared to things like lowered supply and market manipulation.